LETTERS OF VERIFICATION

This material references Disclosure 102-56 of GRI 102: General Disclosures 2016

Opinion

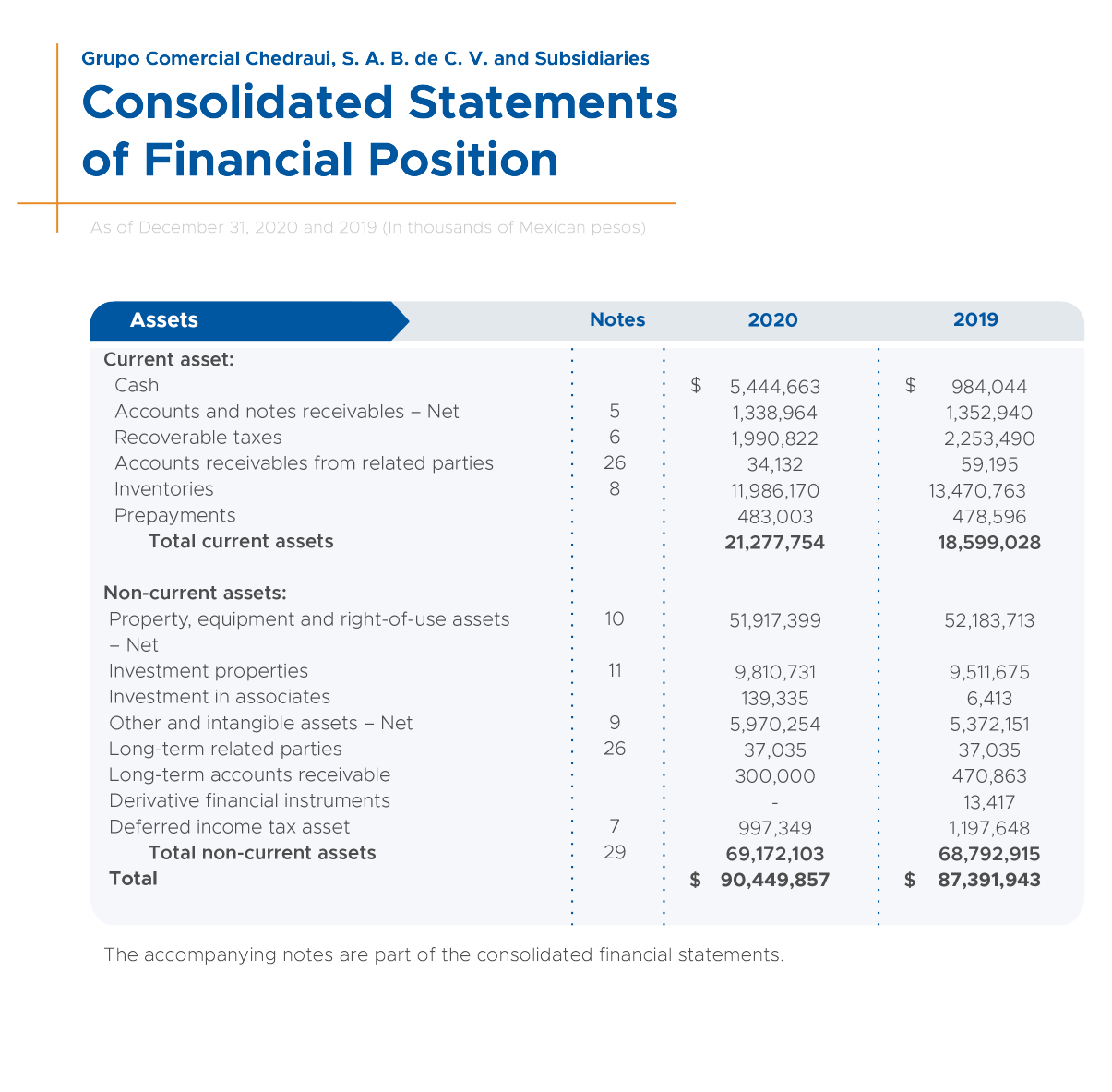

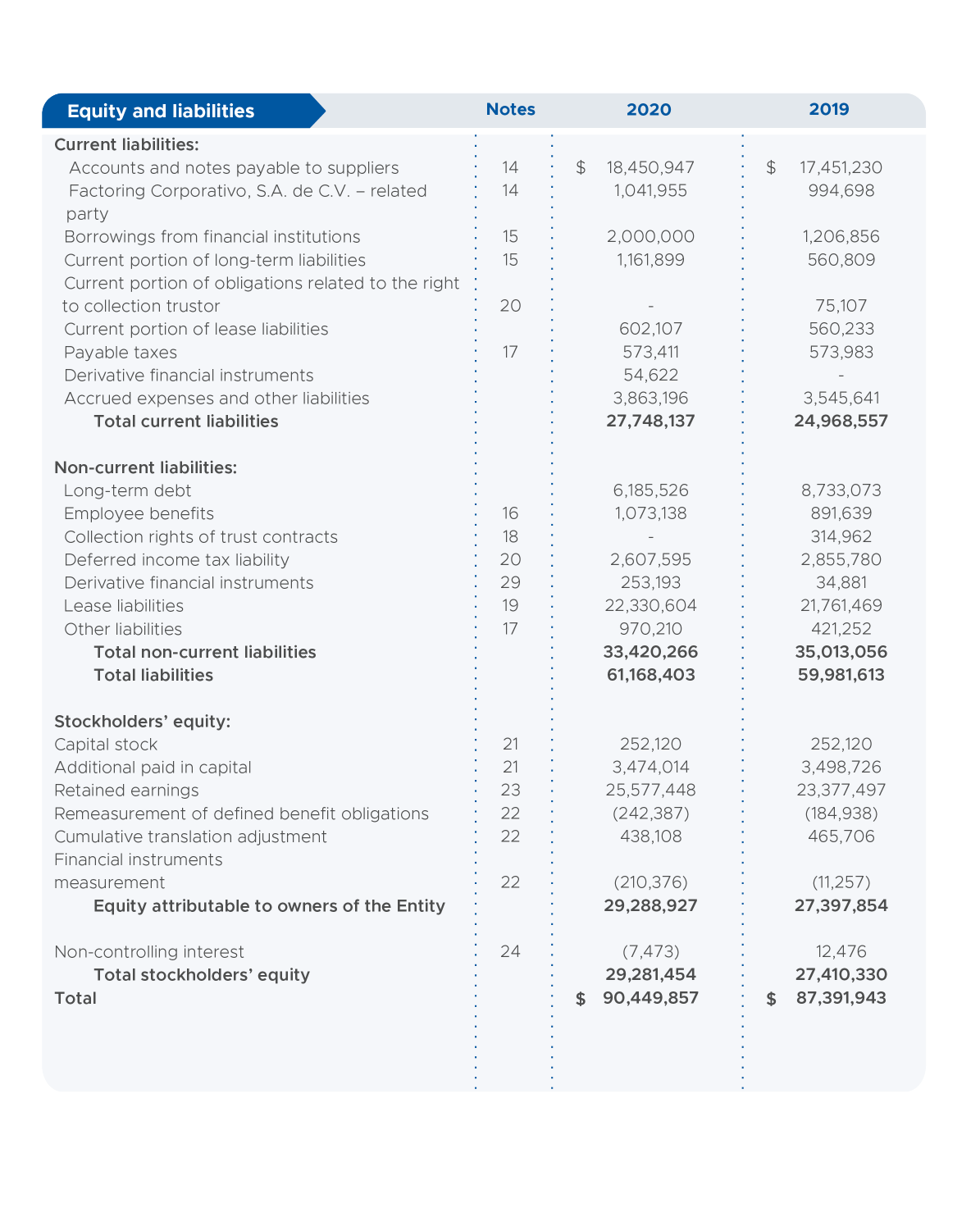

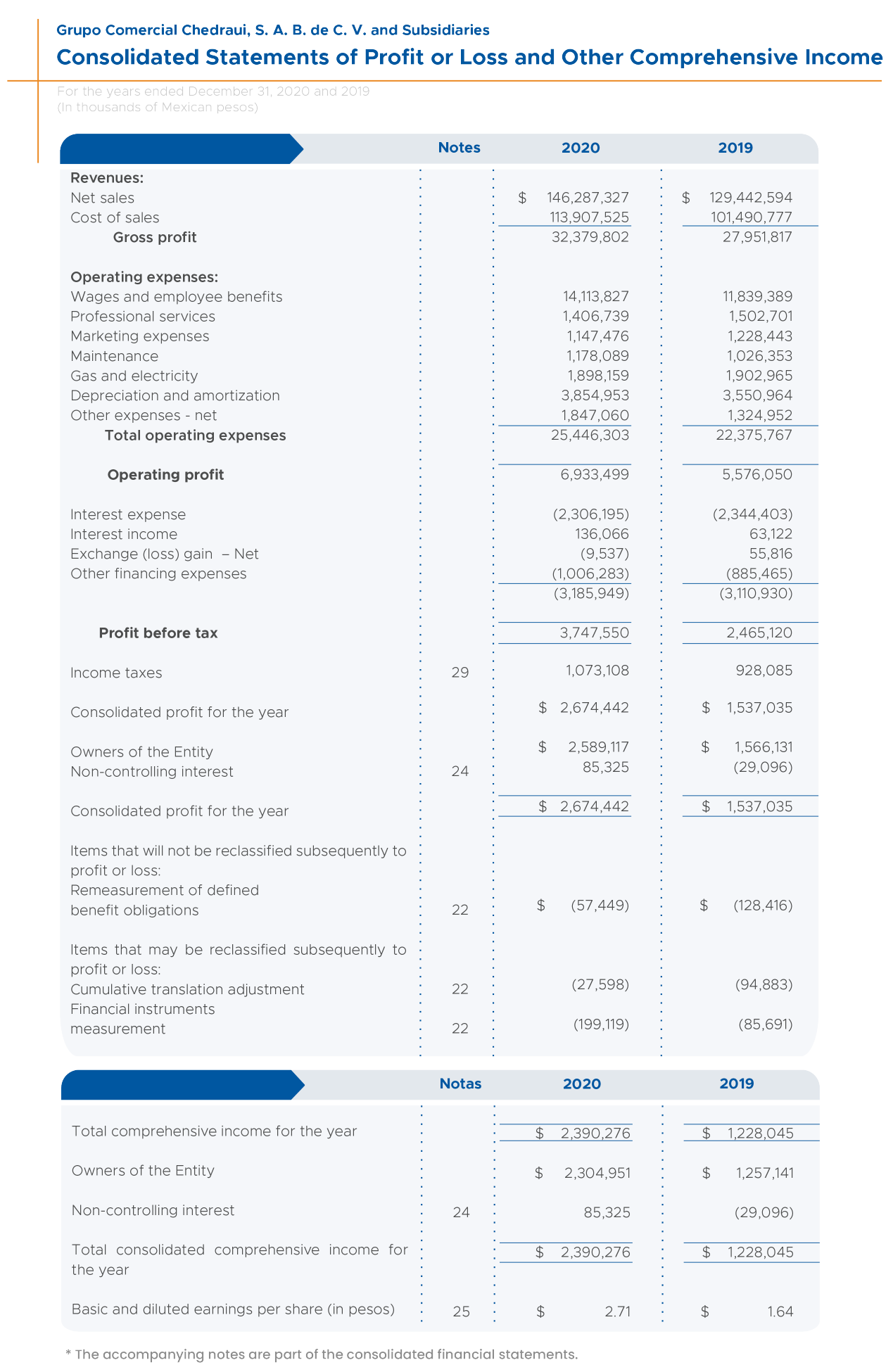

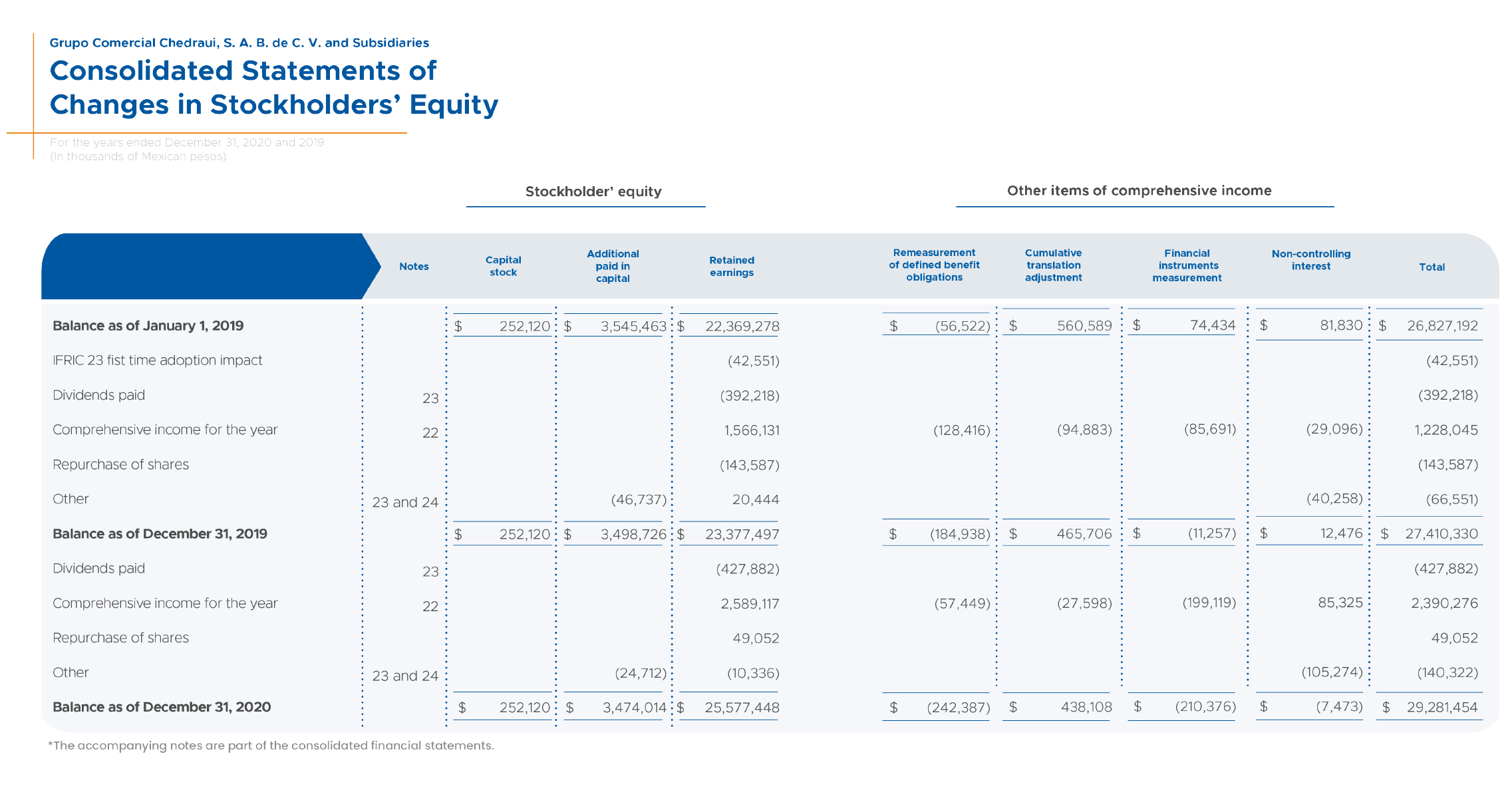

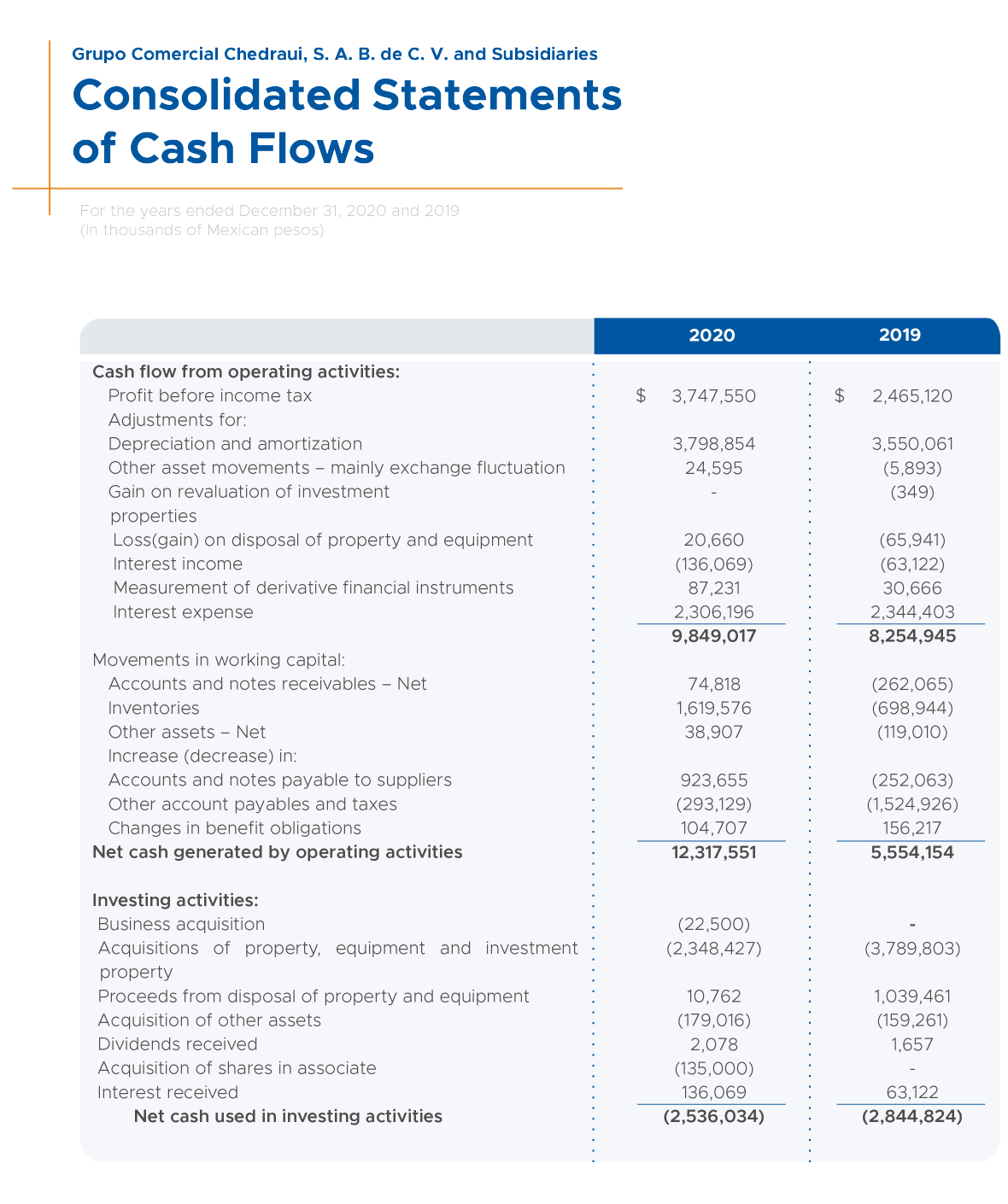

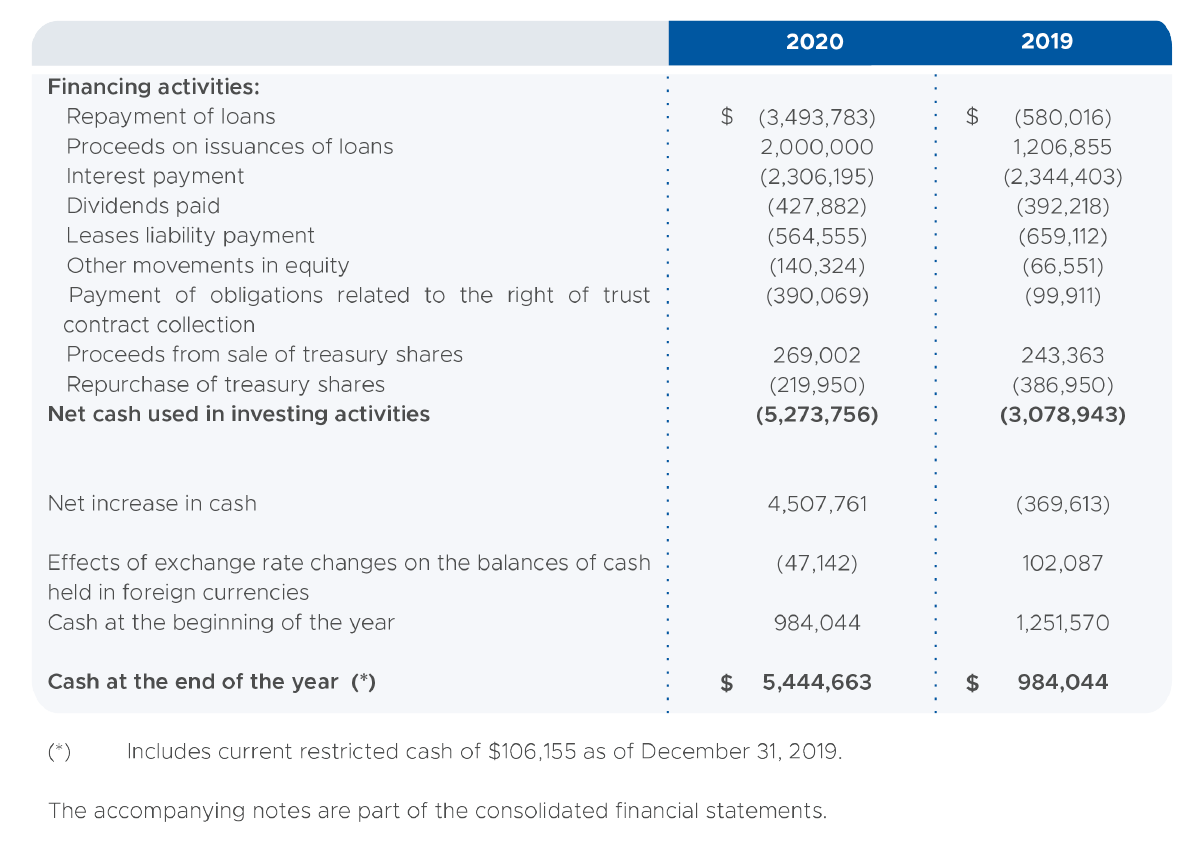

We have audited the consolidated financial statements of Grupo Comercial Chedraui, S. A. B.

de

C. V. and Subsidiaries (the Entity) which include the consolidated statements of financial

position as of December 31, 2020 and 2019, the related consolidated statements of profit or

loss

and other comprehensive income, changes in stockholders’ equity and cash flows for the years

then ended December 31, 2020 and 2019, as well as the explanatory notes to the consolidated

financial statements, which include a summary of the significant accounting policies

applied.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Entity as of December 31, 2020 and 2019, as well as their financial performance and their cash flows for the years then ended, in conformity with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board.

Bases for the opinion

We have performed our audits in conformity with International Auditing Standards (IAS). Our

responsibilities under these standards are explained more extensively in the section

Auditors’

responsibilities in relation to the audit of the consolidated financial statements of

our

report. We are independent from the Entity in conformity with the Code of Ethics of the

International Ethics Standards Board for Accountants (IESBA Code of Ethics) and that issued

by

the Mexican Institute of Public Accountants (IMCP Code of Ethics), and we have complied with

the

other ethical responsibilities in conformity with the IESBA Code of Ethics and the IMCP Code

of

Ethics. We believe that the audit evidence obtained provides a sufficient and adequate basis

for

our opinion.

Key audit matters

The key audit matters are those matters which, in our professional judgment, have been most

important in our audit of the consolidated financial statements for the current period.

These

matters have been dealt with in the context of our audit of the consolidated financial

statements taken as a whole and in the formation of our opinion on the latter, and we do not

issue a separate opinion on these matters. We have determined that the matters described

below

are the key audit matters which should be communicated in our report.

Investment properties

To determine the fair value of the investment properties in accordance with International

Accounting Standard 40 (“IAS 40”), certain judgments were used by management. There is a

risk

that the determination of the assumptions used by management to calculate future cash flows

may

not be reasonable based on current and future foreseeable conditions.

Our audit procedures to cover this risk included the following:

Control and substantive testing over the financial projections that were used to determine

the

fair value of the investment properties, for which we tested the reasonability of the

revenues

and expenses used to determine the discounted future cash flows, also, we tested the

arithmetical accuracy of the projections, and evaluated

the assumptions used by the Entity

to

determine them, and confirmed, based on our knowledge of the Entity and the audited

historical

information, that any nonrecurring effect will be normalized so that such effects will not

be

considered in the financial projections.

Additionally, we evaluated the reasonableness of the discount rate used, for which

purpose we

involved our financial advisory specialists. The results of our audit procedures were

reasonable.

Notes 3 and 11 to the consolidated financial statements include the Entity’s disclosures

regarding investment properties.

Impairment of long-lived assets

The Entity has identified that the minimum cash generating units are the stores, for which

an

analysis is performed as required by International Auditing Standard 36 (“IAS 36”), in which

the

value in use, either using discounted future cash flows or fair value calculations, is

calculated to determine if the carrying amount of the assets is impaired. There is a risk

that

the determination of the assumptions used by management to calculate future cash flows, as

well

as the appraisal value determined by the independent expert, may not be reasonable based on

current and future foreseeable conditions.

Our audit procedures to test the risk in relation to the impairment of long-lived assets

included:

Control and substantive testing where we detail tested the projected income and expenses,

and

based on discounted cash flows; we further verified, based on our knowledge of the Entity

and

the audited historical information, that any nonrecurring effect will be normalized in the

financial projections. We also evaluated the reasonableness of the discount rate used, for

which

purpose we involved our financial advisory specialists. The results of our audit procedures

were

reasonable.

Information other than the Financial Statements and Auditor’s Report

Management is responsible for the other information. The other information comprises two

documents, the Entity's Annual Report and the information that will be incorporated in the

Annual Report which the Entity is required to prepare in accordance with article 33 Fraction

I,

subsection b) of the fourth title, first chapter of the General Provisions Applicable to

Issuers

of Securities and Other Participants in the Securities Market in Mexico (the requirements).

As

of the date of our auditor’s report, we have not yet obtained these documents and they will

be

available only after the issuance of this Audit Report.

Our opinion of the consolidated financial statements does not cover the other information

and we

do not express any form of security about it.

Other Matter

The accompanying consolidated financial statements have been translated into English for the

convenience of readers.

In connection with our audit of the consolidated financial statements, our responsibility is

to

read the other information and, in doing so, consider whether if the other information is

materially inconsistent with the consolidated financial statements or our knowledge obtained

during the audit or otherwise appears to be materially misstated. When we read the Annual

Report

we will issue the auditors’ legend about the reading thereof, required in Article 33

Fraction I,

subsection b) numeral 1.2. of the Provisions or if we conclude that it is materially

misstated

we would be required to report this fact.

Responsibilities of Management and those charged with governance for the consolidated

financial statements

Management is responsible for the preparation and reasonable presentation of the

accompanying

consolidated financial statements in conformity with the IFRS, and for any internal control

that

management believes necessary to enable the preparation of the consolidated financial

statements

free from material misstatement due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing

the

Entity’s ability to continue as a going concern, disclosing,

as applicable, matters related to

going concern and using the going concern basis of accounting unless management either

intends

to liquidate the Entity or to cease operations, or has no realistic alternative but to do

so.

Those charged with governance are responsible for overseeing the Entity’s financial

reporting

process.

Auditor’s responsibilities in relation to the audit of the consolidated financial

statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial

statements as a whole are free from material misstatement, whether due to fraud or error,

and to

issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of

assurance, but is not a guarantee that an audit conducted in accordance with ISAs will

always

detect a material misstatement when it exists. Misstatements can arise from fraud or error

and

are considered material if, individually or in the aggregate, they could reasonably be

expected

to influence the economic decisions of users taken on the basis of these consolidated

financial

statements.

As part of an audit in accordance with IASs, we exercise professional judgment and maintain

professional skepticism throughout the audit. We also:

- Identify and evaluate the risks of material misstatements in the consolidated financial

statements, due to fraud or error, by designing and applying audit procedures which respond

to

these risks, and by obtaining audit evidence which is sufficient and appropriate to provide

the

basis for our opinion. The risk of not detecting material misstatements resulting from fraud

is

greater than those resulting from an error, because fraud may involve collusion, forgery,

deliberate omissions, intentionally erroneous declarations or the evasion of internal

control.

- Obtain an understanding of internal control relevant to the audit in order to design

audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing

an

opinion on the effectiveness of the Company's internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of

accounting estimates and related disclosures made by management.

- Conclude on the appropriateness of management’s use of the going concern basis of

accounting

and, based on the audit evidence obtained, whether a material uncertainty exists related to

events or conditions that may cast significant doubt on the Company’s ability to continue as

a

going concern. If we conclude that a material uncertainty exists, we are required to draw

attention in our auditor’s report to the related disclosures in the financial statements or,

if

such disclosures are inadequate, to modify our opinion. Our conclusions are based on the

audit

evidence obtained up to the date of our auditor’s report. However, future events or

conditions

may cause the Company to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the financial statements,

including the disclosures, and whether the financial statements represent the underlying

transactions and events in a manner that achieves fair presentation.

- We obtained sufficient and adequate audit evidence related to the financial information

of

the entities and business activities which comprise the Entity in order to express an

opinion on

the consolidated financial statements. We are responsible for the direction, supervision and

performance of the audit of the entities comprising the Entity. We are the only persons

responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the

planned

scope and timing of the audit and significant audit findings, including any significant

deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with

relevant ethical requirements regarding independence, and to communicate with them all

relationships and other matters that may reasonably be thought to bear on our independence,

and

where applicable, related safeguards.

From the matters communicated with those charged with governance, we determine those matters

that were of most significance in the audit of the financial statements of the current

period

and are therefore the key audit matters. We describe these matters in our auditor’s report

unless law or regulation precludes public disclosure about the matter or when, in extremely

rare

circumstances, we determine that a matter should not be communicated in our report because

the

adverse consequences of doing so would reasonably be expected to outweigh the public

interest

benefits of such communication.

Galaz, Yamazaki, Ruiz Urquiza, S. C.

Member of Deloitte Touche Tohmatsu Limited

C. P. C. Erick J. Calvillo Rello

March 16, 2021

CORPORATE HEADQUARTERS:

MEXICO HEADQUARTERS

Avenida Constituyentes 1150

Colonia Lomas Altas

11950 Mexico City, Mexico

Phone +52 (55) 1103 8000

XALAPA HEADQUARTERS

Privada Antonio Chedraui Caram 248

Colonia Encinal

91180 Xalapa, Veracruz

Phone +52 (228) 842 1100

STOCK EXCHANGE

Mexican Stock Exchange (BMV):

ticker CHDRAUI

AUDITOR

Galaz Yamazaki, Ruiz Urquiza, S.C.

(Deloitte Touche Unlimited)

INVESTOR RELATIONS

Jesus Arturo Velazquez Diaz

Subdirector de Información Financiera y

Head of Investor Relations

Phone +52 (228) 842 1117

avelazquez@chedraui.com.mx

This annual report may contain future projections about Grupo Comercial Chedraui S.A.B. de C.V. and its subsidiaries based on assumptions made in good faith by management. Such information, as well as any statements about future events and expectations, are subject to risks and uncertainties as well as factors that could cause the results, performance or profits of the company to be completely different at any time in the future. Such factors include changes in general economic conditions, domestic and international governmental and/or business policies as well as changes in interest rates, inflation and volatility in foreign exchange rates, etc. Because of these risks and factors, actual results could vary materially from the estimates presented in this document. Grupo Comercial Chedraui, S.A.B. de C.V. does not accept responsibility for any such changes.